Columbus housing market softens as new listings and inventory spike

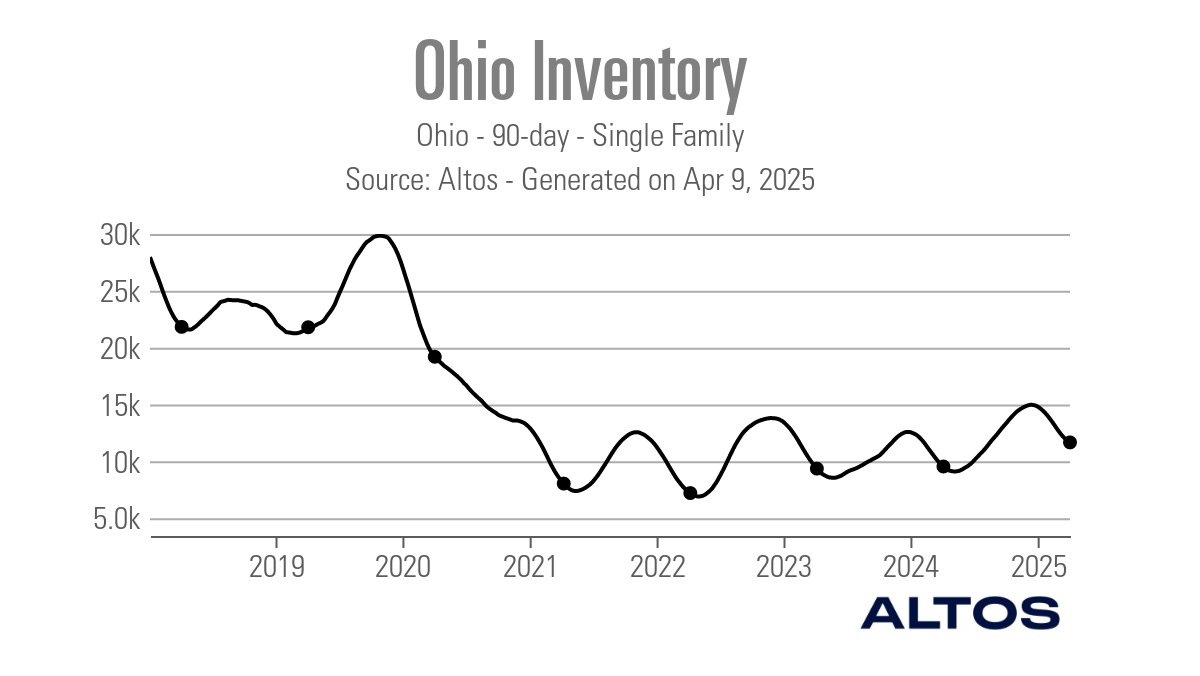

A historically low number of homes for sale has been a fixture of the housing market for years now, giving sellers the upper hand over buyers that have had to trample over each other to secure a purchase.

That might be changing in the Columbus, Ohio metropolitan area. New listings have shot up considerably since mid-January, and overall inventory has risen with it. According to data from Altos, new listings are up 28.1% year over year, and inventory has risen 37%.

This gives buyers more options and a better position in negotiations, but it hasn’t led to a rush of purchases, as pending new home sales have turned negative in recent weeks and currently sit at a 0.7% year-over-year gain.

<\/script>Home-price appreciation declined along with it. Throughout the winter, pending new home prices were consistently up by around 6% but have fallen to 2.9%, suggesting that the rapidly rising inventory is beginning to soften the market.

“Our inventory is probably about as high as it’s been since before COVID,” said Columbus Redfin agent Brad Shields. “I think that’s why buyers are being a little more picky on what they’re purchasing now. Because the market is less competitive and inventory has grown, there’s not quite as much fear of missing out.”

The conditions have made things significantly easier for buyers compared to recent years. The Market Action Index (MAI) from Altos measures whether it’s a buyers or sellers market, with anything above a 30 considered a sellers market.

In May 2022, the MAI in Columbus was a staggering 91, just below the index’s maximum reading of 100. But it’s dropped considerably since then and now sits at 49. That’s still very much a sellers market, but a positive development for buyers.

<\/script>Like every market in the country, Columbus is about to face the elephant in the room — President Donald Trump’s trade war. Trump has jerked the wheel on tariffs a number of times since the beginning of his second term, twice pausing Canadian and Mexican tariffs, and on Wednesday he suspended the global tariffs that he rolled out last week just hours after they took effect.

Tariffs that directly impact homebuilders are still in place, and in the case of China, it’s escalated. According to the National Association of Home Builders (NAHB), China provides 27% of construction materials that are used to build a home, and the Trump Administration has raised the tariff on China to a staggering 145%.

A 10% blanket tariff on all imports is currently in effect, as is a 25% levy on all steel and aluminum imports. A study conducted by John Burns Real Estate Consulting (JBREC) conducted prior to the escalation on China concluded that tariffs will add $12,800 to the cost of building a home.

Housing market economists fear that any inflation caused by this tariff approach could negatively impact demand, as households reconfigure their budgets to account for higher prices on everyday goods and services.

While there are early indications in some markets that the uncertainty alone is changing consumer behavior, Shields says he hasn’t seen much of an impact.

“I don’t think it’s been overly significant at this point,” Shields said. “I do think buyers and sellers both are a little more on alert, so to speak. It definitely comes up in questions if I’m doing a home tour or at a listing consult.”

Categories

Recent Posts